In a bid to simplify auto registration for the IEC holders, the Central Board of Indirect Taxes and Customs ( CBIC ) has informed that the IEC holders can register with the Goods and Services Tax Identification Number (GSTIN). It was said that no Digital Signature is required for the same.

The facility is now available on www.icegate.gov.in.

“IEC holders (Importer/Exporter) can now register at ICEGATE without Digital Signature. Registration is allowed with IEC and any of one GSTIN attached to it. Please choose one GSTIN carefully, pertaining to the IEC,” the CBIC said.

Presently, IEC Registration is allowed on ICEGATE website, with Digital Signature and requires approval. Such registered IEC holders can file documents on ICEGATE. To attract importers and exporters for Registration on ICEGATE and to provide them with various information services including reports, a need is felt to provide a Simplified Auto Registration on ICEGATE.

This Simplified Auto Registration is based on IEC and GSTIN, requires OTP verifications of e-mail and mobile number. The simplified Registration Module in ICEGATE is designed to register at the ICEGATE without the need to upload the Digital Signature Certificate (DSC), PAN verification, document upload to ICEGATE and approval procedure.

In connection with this, the Board has also issued an advisory explaining the different cases of simplified Registration Process.

Advisory for Simplified Auto Registration at ICEGATE

Presently, IEC Registration is allowed on ICEGATE website, with Digital Signature and requires approval. Such registered IEC holders can file documents on ICEGATE. To attract importers and exporters for Registration on ICEGATE and to provide them various information services including reports, a need is felt to provide a Simplified Auto Registration on ICEGATE. This Simplified Auto Registration is based on IEC and GSTIN, requires OTP verifications of e-mail and mobile number.

The simplified Registration Module in ICEGATE is designed to register at the ICEGATE without the need to upload the Digital Signature Certificate (DSC), PAN verification, document upload to ICEGATE and approval procedure.

Note: IEC holders registered under Simplified Auto Registration category are not permitted to file Customs documents

The different cases of simplified Registration Process are explained below with a demo:

Case 1:

1. To Sign Up as new user, click the Simplified Registration link.

2. The following page opens:

The Registrant needs to provide his/her IEC, GSTIN and temporary password sent from ICEGATE on this page.

3. After Step 2, the registrant needs to enter an ICEGATE ID and password of his/her choice. Email ID and mobile number will be auto populated. The ICEGATE ID should be unique and follow the nomenclature of ICEGATE ID provided in this page. The password should be complex and should contains number, special character and different cases.

4. In case if the detail provided do not match with required data at ICEGATE. Error message will be displayed on this page.

5. If the entered values are validated successfully. The registrant will be redirected to OTP authentication page. Two different OTPs on mobile and email mentioned in previous page are sent.

6. If any of the OTP is invalid, then error message will be displayed.

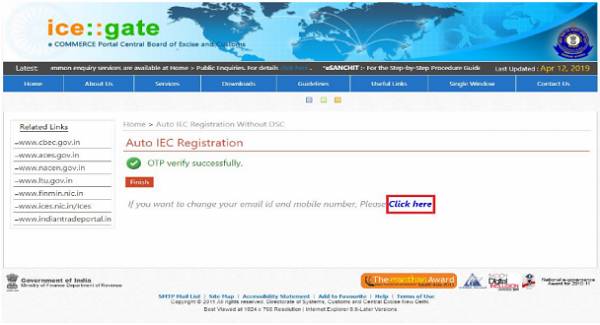

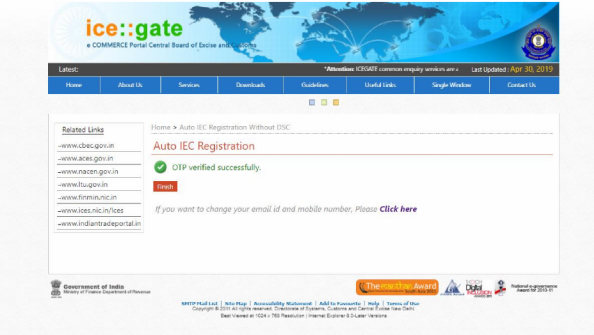

7. If the OTP is verified successfully. Below page will be displayed.

8. On this page, registrant can either finish the process or proceed to change his mobile number and email ID associated with his/her IEC and GSTIN for the selected ICEGATE ID:

Case 1.1: If the user wants to finish the process and do not want to change the email ID and mobile number.

In this case user clicks on the Finish button.

The message is displayed confirming “Are you sure you want to finish the auto IEC Registration Process.”

On Clicking OK, successful message will be displayed.

The simplified Registration Process is finished. Please login with the ICEGATE ID generated.

Case 1.2:

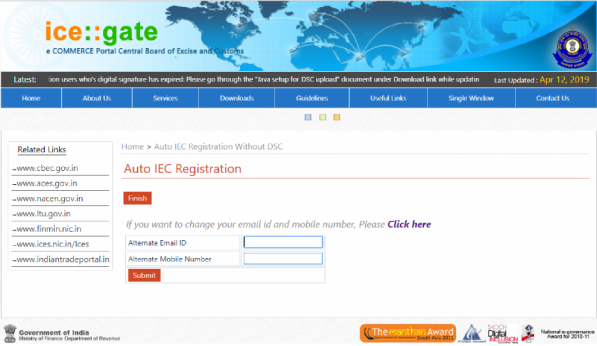

If the user does not want to finish the process and want to change the email ID and mobile number so that new email ID and mobile number could be used for communication for his newly created ICEGATE ID. User will click on the Click here link.

After clicking on the “Click here” link, textbox to enter new email ID and mobile number will be displayed.

The user enters Alternate Email ID and Alternate Mobile Number. Both the fields are mandatory.

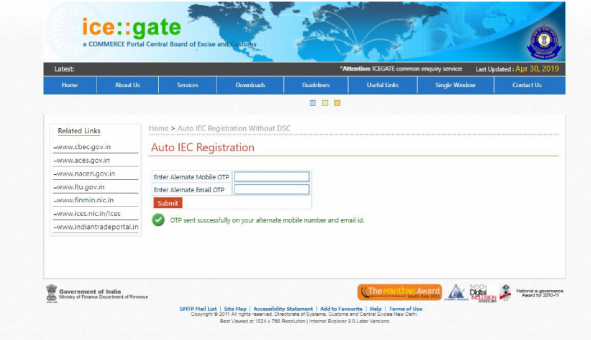

After submitting the above page, the OTP is sent on the registered e-mail and the mobile number.

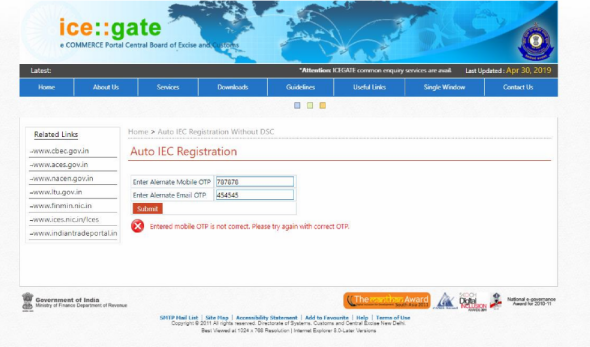

Both Alternate Mobile OTP and Email OTP are mandatory. If any of the OTP is invalid, then appropriate message will be displayed

Successful message will be displayed if all the OTPs are validated successfully. The simplified registration process is complete and registrant may login into ICEGATE with his/her newly created ICEGATE ID.

Case 2:

When the user has already received the Mobile OTP and Email OTP but was not able to verify these either due to the session timeout or due to any other issue and needs to process the data again.

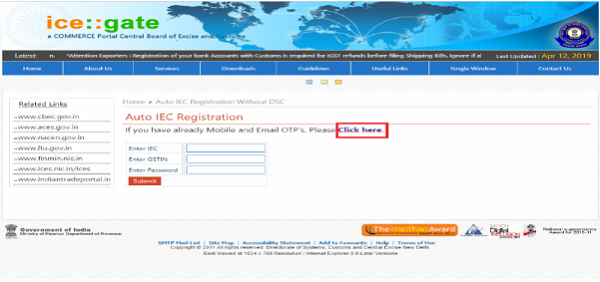

1. In this case the user will click on the link ‘If you already have Mobile and Email OTP’s, please “Click Here”.’

2. The following page opens on clicking the link

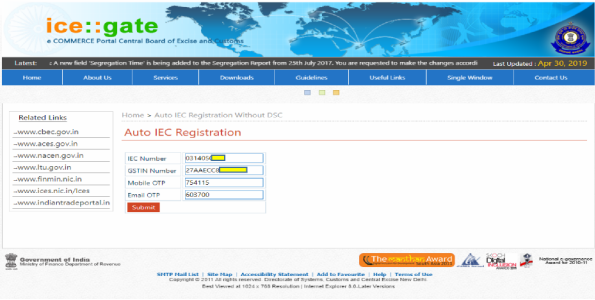

3. Now the IEC Number, GSTIN Number, Mobile OTP and Email OTP are entered and the Submit button is clicked.

4. On submission the following page is displayed:

5. Now the user can either Finish as explained above in CASE 1.1 or the user can change the email id and mobile number by clicking on the link as explained in the CASE 1.2

6. Now if the user wants to change the email ID and mobile number and due to some issue user is not able to enter the mobile OTP and email OTP during the process and wants the data to be processed again user can follow the similar process as explained in CASE 2.

7. Please note that the mobile and email OTP expire after 2 hrs. of generation. If the user is not able to verify the mobile and email OTP within 2 hrs. of their generation the user needs to start fresh as explained in CASE 1.

0 Comments