1. What is Form GSTR-9C?

Form GSTR-9C is a reconciliation statement, duly verified and signed by Chartered Accountant/ Cost Accountant, and required to be furnished along with filing of annual return in Form GSTR-9 by the taxpayer whose turnover is above Rs.2 Crores during a financial year.

2. Who needs to file Form GSTR-9C?

Every taxpayer is supposed to file GSTR-9C and required to get his accounts audited by Chartered/Cost Accountant when turnover during a financial year exceeds the prescribed limit, along with filing of his/her annual return in Form GSTR-9.

This requirement is not applicable to Central Government or a State Government or a local authority,whose books of account are subject to audit by the Comptroller and Auditor-General of India or an auditor appointed for auditing the accounts of local authorities under any law for the time being in force.

3. Who needs to get his accounts audited by Chartered/Cost Accountant?

Normal taxpayer (including SEZ unit and developer) with aggregate turnover exceeding 2 crore rupees during the financial year is required to get its accounts audited.

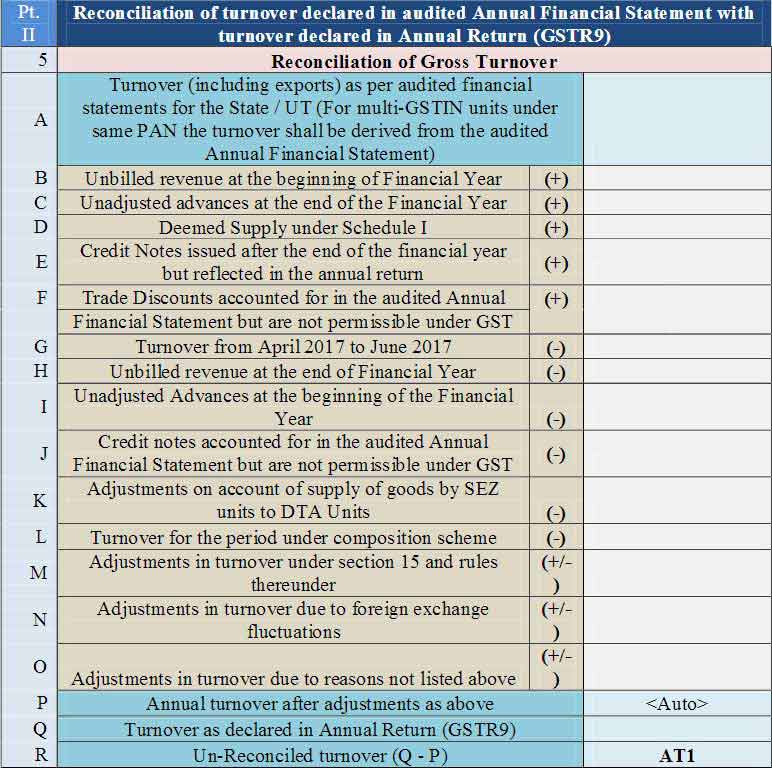

4. What details are to be filed in Form GSTR-9C?

Form GSTR-9C is a reconciliation statement reconciling the turnover declared in audited Annual Financial Statement with Turnover declared in the furnished Annual Return (GSTR9).

5. Will I be allowed to file Form GSTR-9C if I have not filed my annual return?

No, Form GSTR-9C can be filed only after filing the annual return in Form GSTR-9.

6. What are the pre-conditions for filing Form GSTR9C?

- User should be registered and should have a valid GSTIN.

- User should have valid login credentials (i.e., User ID and password) Designed and Developed by GSTN

- User has filed GSTR-9 for the relevant financial year.

- The aggregate turnover of such registered person during the financial year exceeds two crore rupees

- He should have got his accounts audited as specified.

7. By when do I need to file the Form GSTR-9C?

The due date for filing Form GSTR-9C for a particular financial year is 31st December of subsequent financial year or as notified by Government.

8. When does the system enable filing of Form GSTR9C?

GSTR-9C tile shall be enabled only after successful filing of GSTR-9 for the financial year.

Form GSTR-9C shall be made available to all taxpayers to whom GSTR-9 is applicable for the financial year.Systems hall not validate whether the turnover of taxpayer exceeds 2 crore rupees or not.

9. How do I fill details in Form GSTR9C?

The taxpayer, or the auditor can download GSTR-9C offline tool (.zip file) from GST Portal and unzip the downloaded file to open excel based offline tool. Fill details in the downloaded offline sheet and validate sheet.

10. From where can I download and use the GSTR-9C Offline Utility in my system?

To download and open the GSTR-9C Offline Utility in your system from the GST Portal, perform following steps:

- Access the GST Portal:gst.gov.in.

- Go to Downloads > Offline Tools > GSTR-9C Offline Tool option and click onit.

- Unzip the downloaded Zip file which contain GSTR_9c_Offline_Utility.xls excelsheet.

- Open the GSTR_9c_Offline_Utility.xls excel sheet by double clicking onit.

- Read the ‘Read Me’ instructions on excel sheet and then fill the work sheet accordingly.

11. Do I need to login to GST Portal to download the GSTR-9C Offline Utility?

No. You can download the GSTR-9C Offline Utility under ‘Downloads’ section without logging in to the GST Portal.

12. Do I need to login to GST Portal to upload the generated JSON file using GSTR-9C Offline Utility?

Yes. Taxpayer must login in to the GST Portal to upload the generated JSON file using GSTR- 9C Offline Utility.

Log in to GST portal àAnnual return àSelect Financial year and click on Search àClick on ‘Prepare Offline’ option in GSTR-9C tile àGo to ‘upload’ tab.

13. What are the basic system requirements/configurations required to use GSTR-9C Offline Tool?

The offline functions work best on Windows 7 and above and MSEXCEL 2007 and above.

14. Is Offline utility mobile compatible?

As of now GSTR-9C Offline utility cannot be used on mobile. It can only be used on desktop/laptops.

15 .Will there be any system computed fields and data auto-populated in Form GSTR9C?

Taxpayer can download the ‘System generated summary based on GSTR-9’ in PDF file from the portal by clicking on ‘Download GSTR-9C tables derived from GSTR-9(PDF)’ button.

Downloaded PDF can be handed over/passed on to auditor. Auditor can use the same to fill the GSTR-9 related fields in GSTR-9C.

‘System generated summary based on GSTR-9’ filed shall have the following fields:

- Turnover as declared in Annual return(GSTR-9)

- Taxable turnover as per liability declared in Annual Return(GSTR-9)

- Total amount of Tax paid as declared in Annual Return (GSTR-9)

- ITC claimed in Annual Return(GSTR-9)

- ITC claimed in Annual Return(GSTR-9)

16. How would Form GSTR 9C be verified and signed by Chartered Accountant/ Cost Accountant?

Chartered Accountant/Cost Accountant shall use the offline tool to fill up the required details and the Certificate.He would generate a JSON file after validation and upload the file.After generating JSON the Auditor shall affix his digital signature.

17. Who would upload the Form GSTR9C?

Chartered Accountant/ Cost Accountant after verification and signing shall pass on the signed JSON file to taxpayer for upload of Form GSTR 9C. It is to be uploaded on GST portal by the taxpayer,after verification,along with a copy of the following documents BalanceSheet,Income and Expenditure Account/ Profit and Loss Account and any other document.

18. Can I download draft Form GSTR 9C before filing?

Yes. Draft GSTR-9C in PDF format can be downloaded after the upload of JSON file.

19. What is the format to be used for upload of Form GSTR9C?

Upload format allowed for GSTR-9C is JSON only and upload format allowed for Balance Sheet, Profit and Loss Account/ Income and Expenditure Account and any other document is PDF only.

20. Is there any limit on the size of documents required to be uploaded?

Limit of upload for following documents under each section shall be 2 files and each file size should not exceed 5 MB:

- Balance Sheet

- Profit and Loss Account/Income and Expenditure Account

- Other document 1, if any

- Other document 2, if any

21. Can I make any changes in the JSON file uploaded by the Auditor?

No,you cannot make any changes in the JSON file uploaded by the Auditor. Systems hall validate that no changes have been made by taxpayer in JSON signed by auditor.

22. What can I do if Auditor has made recommendation on additional liability to be discharged by taxpayer?

You are given an option to navigate to GST DRC 03 for making payment towards additional liability. After making payment through GST DRC 03, you will be navigated back to Form GSTR 9C.

23. What can I do in case of any error shown by system on uploading the Form GSTR 9C with necessary documents?

Download the JSON error file and handover it to auditor. Auditor has to open it in offline tool by clickingon“Open downloaded error JSON file”.He would correct errors as per details mentioned in “GST Validation errors” and sign it again after generating JSON.

On upload of signed JSON; system shall validate that no changes have been made in signed JSON by taxpayer.

24. Can I track the status of Form GSTR9C?

Taxpayer can track the status of form GSTR-9C through ‘Track return status’ option in Services menu. Once return is filed successfully, then you can check the details in ‘View e-filed returns’ option under Services menu.

25. Can I save and download the filed Form GSTR9C?

Yes, you can save/ download the filed form for future reference. ARN and date of ARN will also be shown on summary downloaded after filing the form.

26. Can I revise Form GSTR 9C or make any changes init?

Form GSTR-9C once filed cannot be revised. However, changes can be made till filing even post payment through GST DRC-03.

27. I am uploading GSTR-9C JSON File again, after making changes. What will happen to details of the previous upload?

Do I need to click on ‘save’ button in ‘upload relevant documents page’ after every upload?If some details exist from previous upload, it will be updated with latest uploaded details. All new entries will be added as new entries.

Yes. You need to click on ‘Save’ button after the status is ‘Processed’. Save button shall be enabled only after successful upload of mandatory documents (Balance sheet and Profit & loss statement/Income & expenditure statement)

What will happen if I click on ‘proceed to file’ without clicking on ‘save’ button.

Error message shall be displayed if you click on ‘proceed to file’ without clicking on ‘Save’ button.

28. When proceed to file button shall been abled

‘Proceed to file’ button shall be enabled only after successful upload of

- Signed JSON file

- Balance sheet in PDF/JPEG format

- Profit & Loss statement/ Income & Expenditure statement in PDF/JPEG format and save

29. When ‘File GSTR-9C’ button will be enabled?

‘File GSTR-9C’ button will be enabled only after Proceed to file and select the declaration/verification check box.

30. Can I add/delete the uploaded PDF/JPEG file after clicking on ‘Proceed to file’ or ‘File GSTR-9C’button?

Yes. You can add/delete PDF/JPEG file till successful filing of GSTR-9C. If you have deleted/added any documents, then you have to click on save and proceed file again.

31. Can I download the reconciliation statement in excel format before/after filing of GSTR-9C?

You can download the reconciliation statement details in excel format.

32. Can I download the uploaded PDF/JPEG (Balance sheet, profit &loss statement etc.) and JSON file after successful filing?

Yes. You can download the GSTR-9C JSON/PDF/Excel files by clicking on ‘Download GSTR- 9C’ button in GSTR-9C tile on the and PDF/JPEG uploaded by taxpayer can be downloaded by clicking on ‘View GSTR-9C’ button in GSTR-9C tile.

Click here to download GSTR-9C Offline Utility

ALSO VISIT THIS

EXCEL BASED FROM GSTR 9C

SHOP KARO CASH KARO

0 Comments