Rule 46 of ‘Central Goods and Services Tax (CGST) Rules 2017’: Tax Invoice

Provisions under Rule 46 of the Central Goods and Services Tax (CGST) Rules, 2017 relating to “Tax Invoice”, are as under:

CGST Rule 46: Tax Invoice (Chapter-VI: Tax Invoice, Credit and Debit Notes)

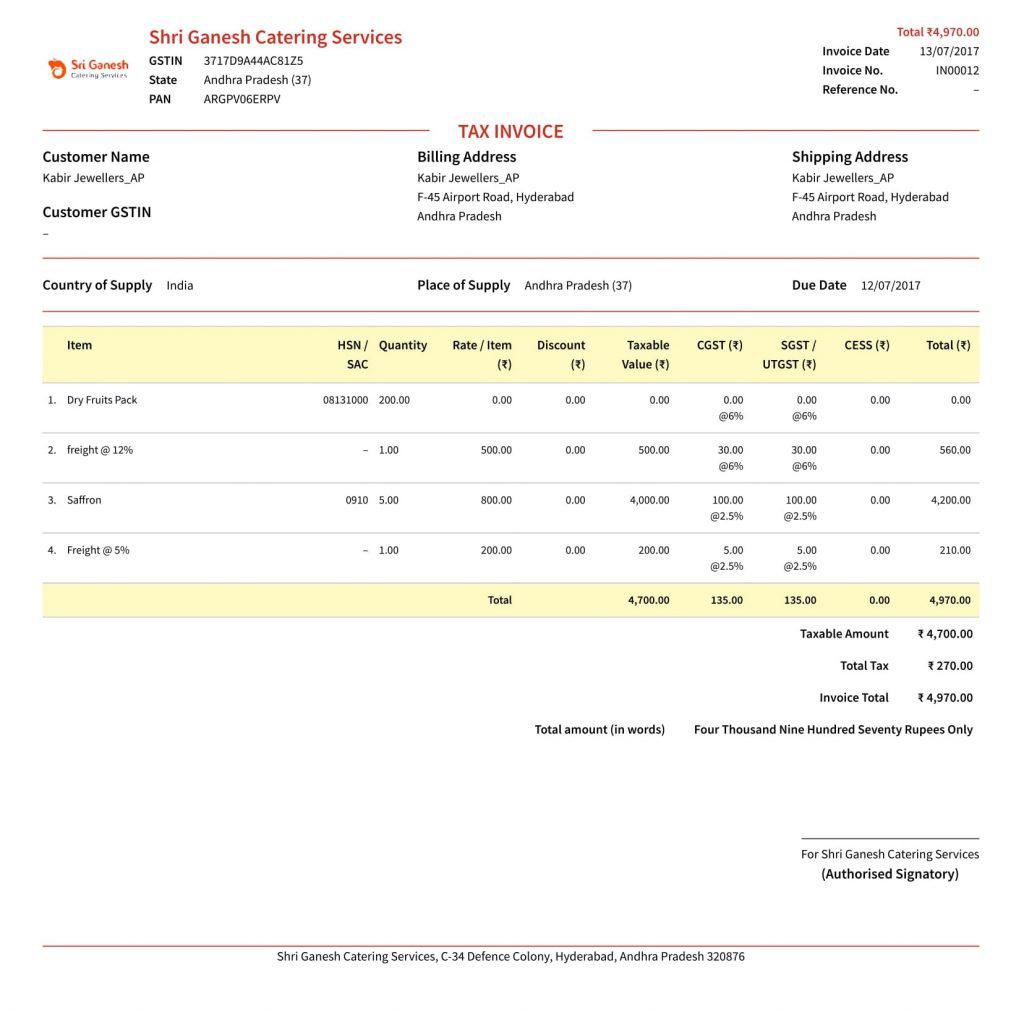

Subject to rule 54, a tax invoice referred to in section 31 shall be issued by the registered person containing the following particulars, namely,-

(a) name, address and Goods and Services Tax Identification Number of the supplier;

(b) a consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters- hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique* for a financial year;

(c) date of its issue;

(d) name, address and Goods and Services Tax Identification Number or Unique Identity Number, if registered, of the recipient;;

(e) name and address of the recipient and the address of delivery, along with the name of the State and its code, if such recipient is un-registered and where the value of the taxable supply is fifty thousand rupees or more;

(e) name and address of the recipient and the address of delivery, along with the name of the State and its code, if such recipient is un-registered and where the value of the taxable supply is fifty thousand rupees or more;

(f) name and address of the recipient and the address of delivery, along with the name of the State and its code, if such recipient is un-registered and where the value of the taxable supply is less than fifty thousand rupees and the recipient requests that such details be recorded in the tax invoice;

(g) Harmonised System of Nomenclature code for goods or services;

(h) description of goods or services;

(i) quantity in case of goods and unit or Unique Quantity Code thereof;;

(j) total value of supply of goods or services or both;

(k) taxable value of the supply of goods or services or both taking into account discount or abatement, if any;

(l) rate of tax (central tax, State tax, integrated tax, Union territory tax or cess);

(m) amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess);

(n) place of supply along with the name of the State, in the case of a supply in the course of inter-State trade or commerce;

(o) address of delivery where the same is different from the place of supply;

(p) whether the tax is payable on reverse charge basis; and

(q) signature or digital signature of the supplier or his authorised representative:

Provided that the Board may, on the recommendations of the Council, by notification, specify-

(i) the number of digits of Harmonised System of Nomenclature code for goods or services that a class of registered persons shall be required to mention, for such period as may be specified in the said notification; and

(ii) the class of registered persons that would not be required to mention the Harmonised System of Nomenclature code for goods or services, for such period as may be specified in the said notification:

Provided further that where an invoice is required to be issued under clause (f) of sub-section (3) of section 31, a registered person may issue a consolidated invoice at the end of a month for supplies covered under sub-section (4) of section 9, the aggregate value of such supplies exceeds rupees five thousand in a day from any or all the suppliers:

[Provided also that in the case of the export of goods or services, the invoice shall carry an endorsement “SUPPLY MEANT FOR EXPORT/SUPPLY TO SEZ UNIT OR SEZ DEVELOPER FOR AUTHORISED OPERATIONS ON PAYMENT OF INTEGRATED TAX” or “SUPPLY MEANT FOR EXPORT/SUPPLY TO SEZ UNIT OR SEZ DEVELOPER FOR AUTHORISED OPERATIONS UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX”, as the case may be, and shall, in lieu of the details specified in clause (e), contain the following details, namely,-

(i) name and address of the recipient;

(ii) address of delivery; and

(iii) name of the country of destination:]$1

Provided also that a registered person may not issue a tax invoice in accordance with the provisions of clause (b) of sub-section (3) of section 31 subject to the following conditions, namely,-

(a) the recipient is not a registered person; and

(b) the recipient does not require such invoice, and

shall issue a consolidated tax invoice for such supplies at the close of each day in respect of all such supplies.

Amendments History:

$1. Third proviso to the CGST Rule 46 substituted vide Notification No. 17/2017 Central Tax dt. 27 July 2017, in place of

“Provided also that in the case of the export of goods or services, the invoice shall carry an endorsement “SUPPLY MEANT FOR EXPORT ON PAYMENT OF INTEGRATED TAX” or “SUPPLY MEANT FOR EXPORT UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX”, as the case may be, and shall, in lieu of the details specified in clause (e), contain the following details, namely,-

(i) name and address of the recipient;

(ii) address of delivery; and

(iii) name of the country of destination.”

—–

Above information is based on Updated Compilation of “CGST Rules 2017” (as amended upto 9 Oct. 2018) shared by CBIC (i.e. as notified/ amended upto 9 Oct. 2018 by the CBIC). However, for detailed/ official information and/or subsequent updates, please refer relevant Notifications. Further, above information is pending updation in line with Updated Compilation of “CGST Rules 2017” (as amended upto 1 Feb. 2019) issued by the CBIC subsequently.

It may be noted that Rules 27 to 138 (pertaining to various Chapters) of the Central Goods and Services Tax (CGST) Rules, 2017 were initially notified by CBIC (CBEC) vide CGST (2nd Amendment) Rules, 2017 Notification No. 10/2017 Central Tax dt. 28 June 2017, applicable w.e.f. 1 July 2017 (or as may be specified in respective Rules).

Also Read This :- Advisory to GST Taxpayers on Invoice Series to be used wef 1st April, 2019

0 Comments